EUR/USD Price Analysis: Bears looking for a premium and eye 1.0800

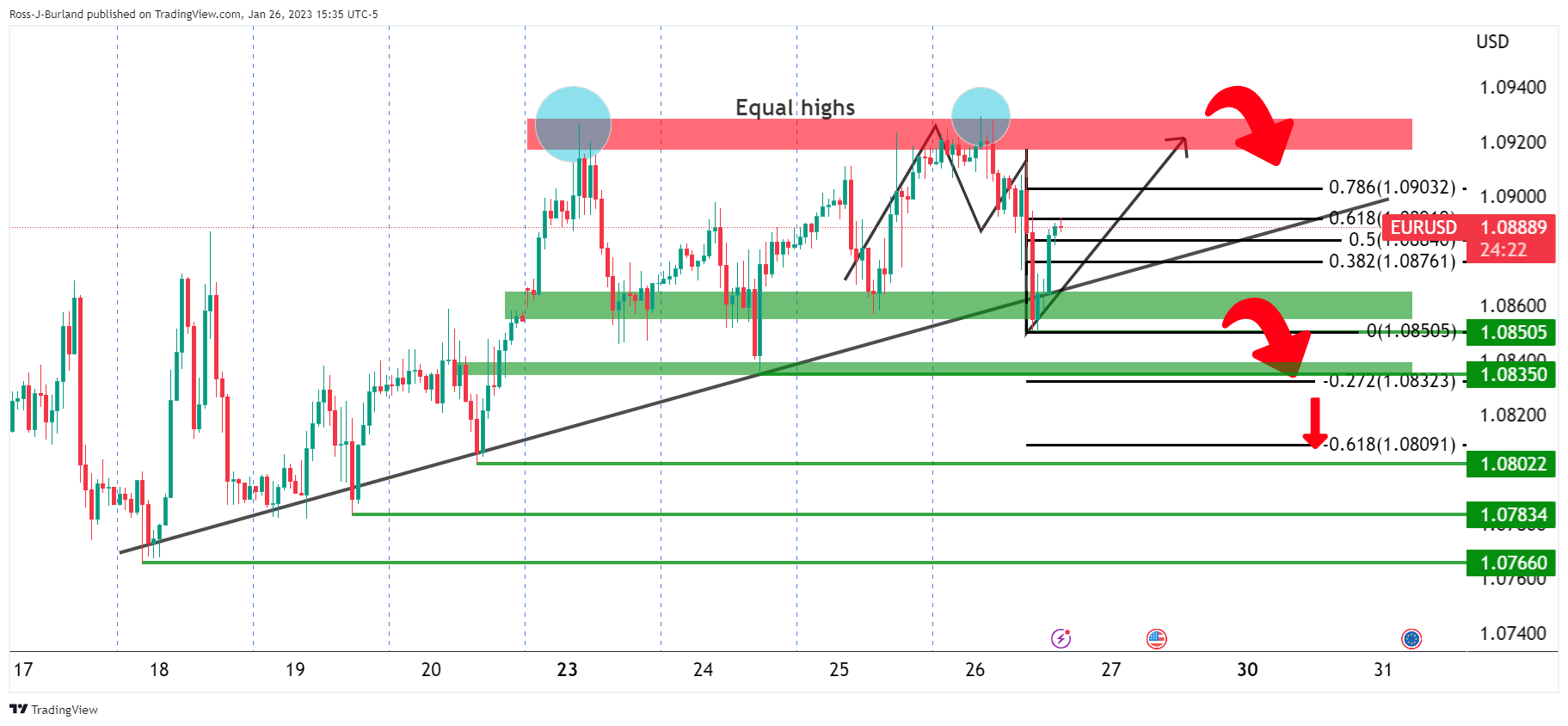

- EUR/USD hourly chart is seeing the price wedged into the coil along the trendline support.

- The trendline will be vulnerable if the US data on Friday rhymes with Thursday's, exposing the 1.08 the figure to the downside.

EUR/USD is running higher in the latter part of the US session following a blow-off to the downside on the back of some generally solid US data on Thursday. The US Dollar has benefitted and has been teasing in markets today, testing key trendline resistance in the 102s:

The pull back into the neckline of the W-formation is giving rise to a bid in the euro:

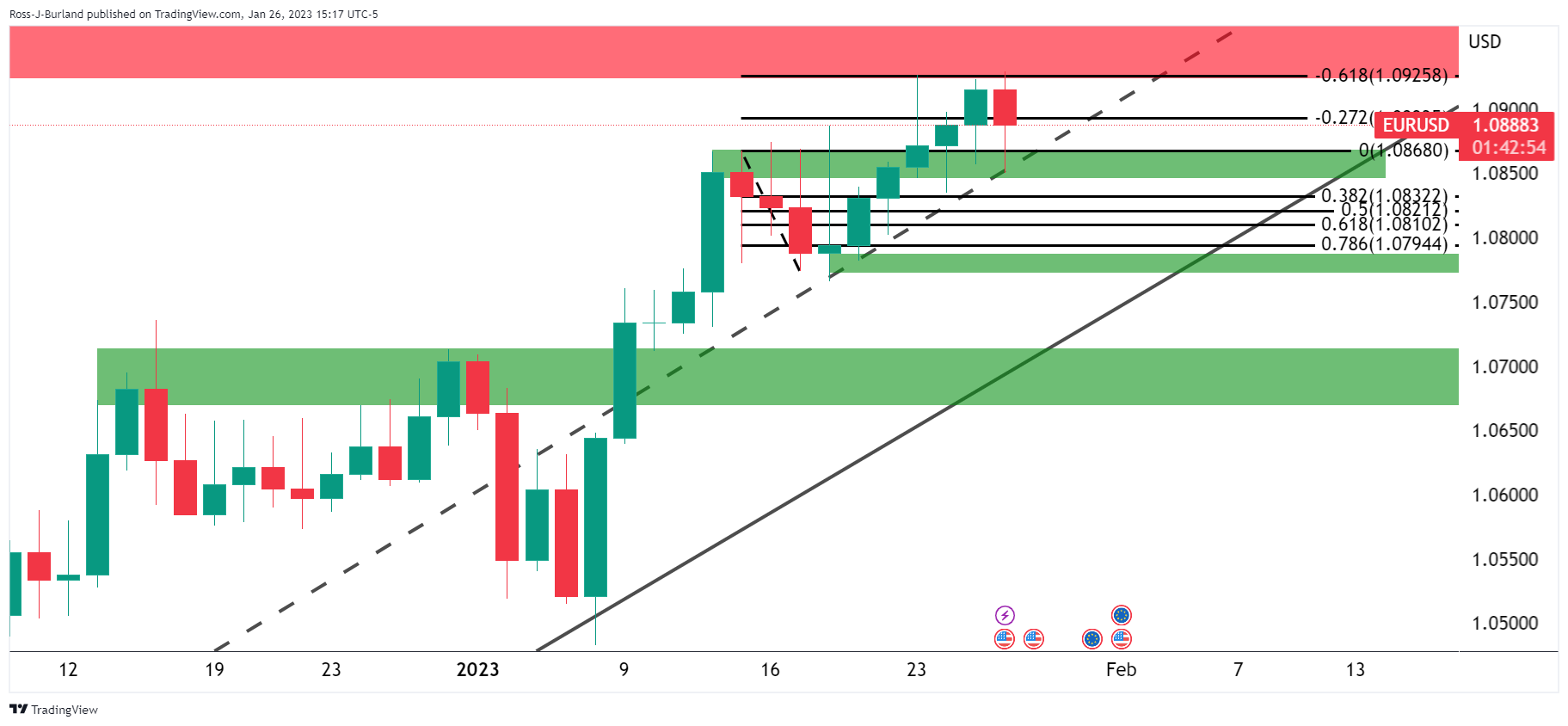

EUR/USD daily charts

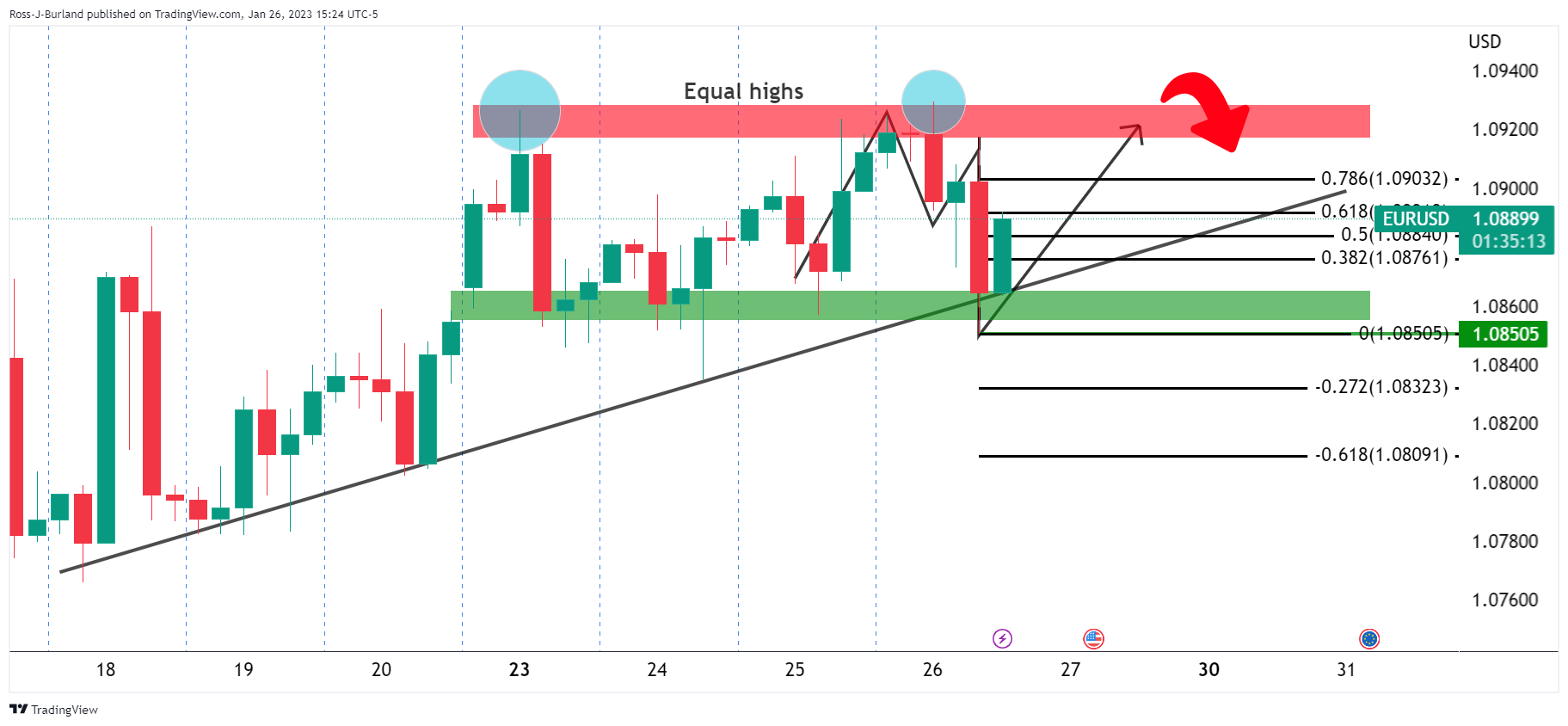

EUR/USD H4 chart

On the 4-hour chart, we have the bulls targeting the 1.0920s and equal highs, moving in hard to the M-formation's neckline. Nevertheless, we are up high on the charts and the price is coiling, which means a breakout could be imminent. With that being said, this could be could before the Federal Reserve but we are guaranteed some price action over the red news on Friday on the US calendar:

EUR/USD H1 chart

The hourly chart is seeing the price wedged into the coil along the trendline support that will be vulnerable if the data on Friday rhymes with Thursday's, exposing the 1.08 the figure to the downside.