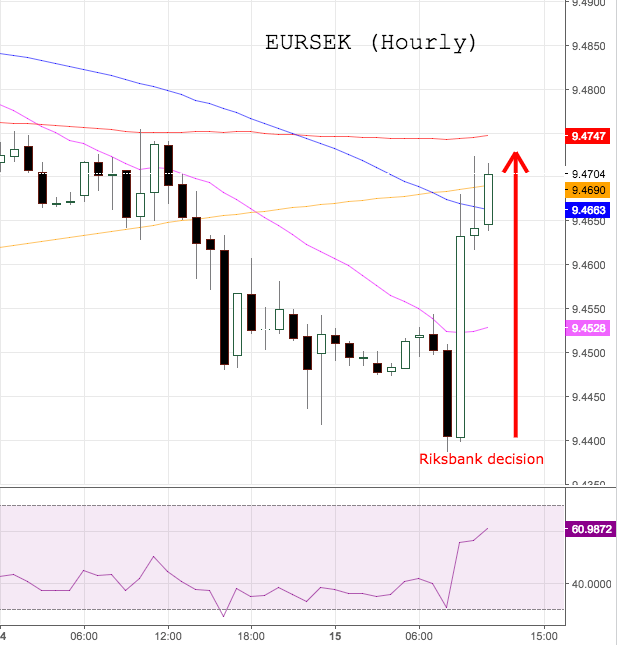

EUR/SEK retreats from highs, back near 9.47 post-Riksbank

The Swedish Krona is trading on the defensive today, lifting EUR/SEK to fresh daily peaks in the mid-9.4700s.

EUR/SEK weaker post-Riksbank

SEK met extra selling pressure after the Riksbank left unchanged its key rate at -0.50% and said it will continue the purchase of sovereign bonds for the first half of the current year. The Executive Board has also decided to extend the bank’s mandate to quickly intervene in the FX markets.

The Riskbank kept its monetary status quo unchanged despite the economic activity continued to strengthen, although political uncertainties overseas remains ‘considerable’.

Regarding inflation, the Riksbank said “For inflation to stabilise around 2 per cent, a continued strong level of economic activity and a krona that does not appreciate too rapidly are required. Monetary policy therefore still needs to remain expansionary”.

In the near term, the Nordic central bank noted that the repo rate is more likely to be cut than to increase.

In the data space, Swedish Capacity Utilization rose 1.0% QoQ in Q4, while February’s inflation expectations gauged by TNS Sifo Prospera are now at 1.7% YoY in the first year, 1.9% in the second year and 2.0% in the fifth year.

EUR/SEK levels to consider

As of writing the cross is advancing 0.24% at 9.4705 and a breakout of 9.4747 (100-day sma) would expose 9.5059 (high Feb.2) and finally 9.5553 (200-day sma). On the other hand, the next down barrier aligns at 9.4387 (low Feb.15) followed by 9.4327 (low Jan.16) and then 9.3958 (2017 low Feb.1).