When is the US ISM Manufacturing PMI and how could it affect EUR/USD?

US ISM Manufacturing PMI Overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI at 14:00 GMT this Tuesday. Consensus estimate point to a modest deceleration in the manufacturing sector activity and the index is seen ticking lower to 51.0 in August from the previous month's reading of 51.2.

Analysts at TD Securities are also looking for a modest decline to 51.0 in August as they expect the back-and-forth in trade retaliations to have maintained the outlook for manufacturing subdued. “Other data was also mixed, as recent firm growth in core durable goods orders suggest some upside, while a weak Markit PMI survey increases the odds for a downside surprise in August.”

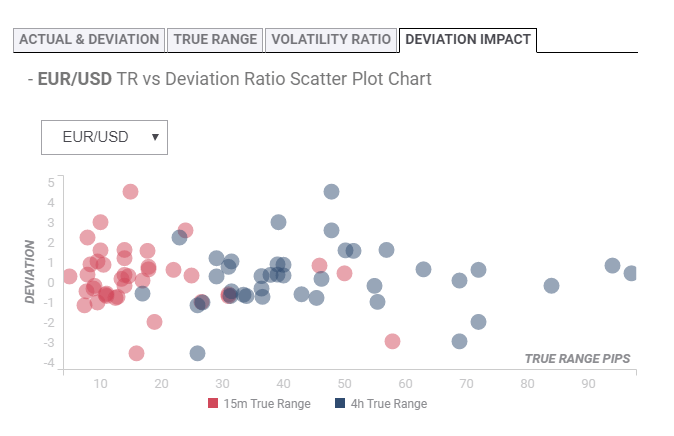

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed, the reaction in case of a relative deviation of -0.74 or +0.67 is likely to be in the range of 13-22 pips in the first 15-minutes and could stretch to around 45-63 pips in the subsequent 4-hours.

How could it affect EUR/USD?

Ahead of the release, Yohay Elam - FXStreet's own Analyst offered important technical levels to trade the EUR/USD pair and wrote – “the first resistance line is a 1.0960, which was the low point on Friday and also a swing low in mid-2017. The psychologically important level of 1.1000 is also significant. Further up, the previous 2019 trough of 1.1027 is the next line to watch. 1.1050, 1.1090, and 1.1130 are next.”

“If EUR/USD ignores oversold conditions, the next cushion below 1.0930 is 1.0900 – a round number and also a resistance line in March 2017. Next, we find 1.0815, which was the upper side of a gap line on April 2017, and then 1.0780 – the lower side of that gap,” he added further.

Key Notes

US Manufacturing Purchasing Managers’ Index Preview: Revival is near

EUR/USD Forecast: How low can it go? Big levels to watch and reasons for a recovery

EUR/USD stays weak, near 1.0930 ahead of US ISM

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).