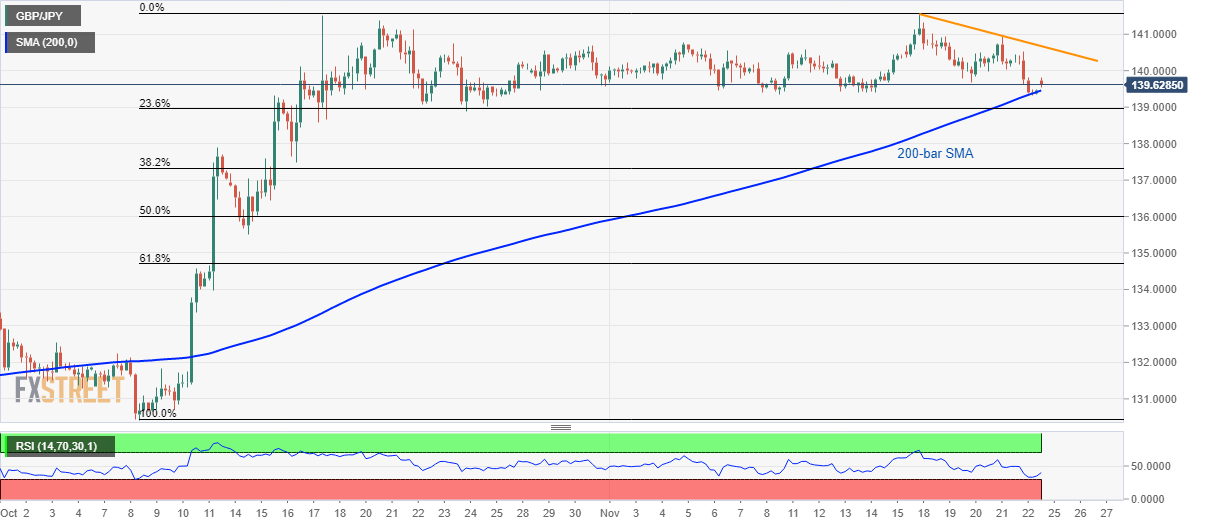

GBP/JPY Technical Analysis: 200-bar SMA guards immediate downside

- GBP/JPY bounces off monthly low amid oversold RSI conditions.

- A one-week-old falling trend line gains buyers’ attention during further recovery.

The GBP/JPY pair recovers from 200-bar SMA while trading around 139.65 during Monday morning in Asia.

The quote’s the recent pullback, amid oversold conditions of 14-bar Relative Strength Index (RSI), shifts bull’s attention to a downward sloping resistance line since November 18, at 140.67 now. However, a sustained clearance of 140.00 round-figure will be necessary for that.

In a case, prices move successfully beyond the near-term key resistance line, monthly to surrounding 141.60 will return to charts.

On the downside, pair’s declines below 200-bar Simple Moving Average (SMA) level of 139.46 can take rest on 23.6% Fibonacci Retracement of October-November upside, at 138.95.

Should there be bearish formation around 138.95, sellers can target October 11 high near 137.90 during further declines.

GBP/JPY 4-hour chart

Trend: Further recovery likely