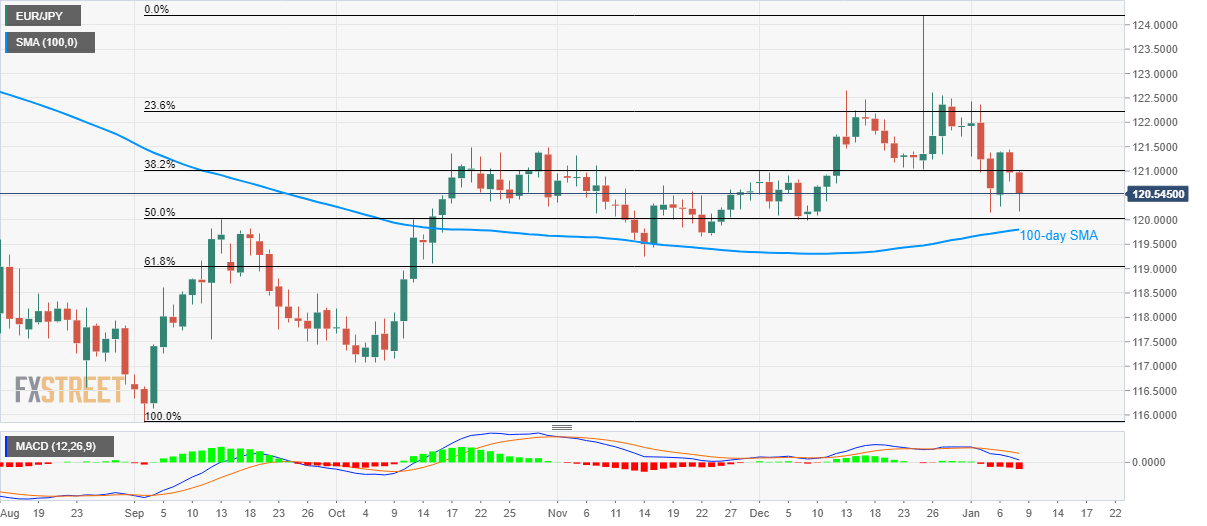

EUR/JPY Technical Analysis: 50% Fibonacci, 100-day SMA in focus amid risk-off

- EUR/JPY drops to three-day low as markets rushed to risk-safety after Iran attacked the US airbase in Iraq.

- Bearish MACD, fundamentals keep signaling further downside.

- Prices maintain three-month-old strength beyond 100-day SMA.

EUR/JPY consolidates the recent losses to 120.61 during early Wednesday. The pair dropped to the low of 120.17 amid initial Asian session as safe-havens like Japanese yen (JPY) benefited from the Iranian strikes.

Read: Iranian and US fighter jets have taken off – Social media rumours

With this, 50% Fibonacci retracement of September-December upside, at 120.00, followed by a 100-day SMA level of 119.80, is on the seller’s radar.

However, prices have been beyond 100-day SMA since mid-October and can repeat the fashion around then. If not, the pair could slip to 61.8% Fibonacci retracement level of 119.00.

Meanwhile, the current week high around 121.50 and high marked on December 13, near 122.66, can keep the pair’s immediate upside captive.

It should, however, be noted that the Bulls will be targeting 125.00 on the sustained break of 122.66.

EUR/JPY daily chart

Trend: Bearish