WTI targets the $22.00 mark on US-Russia deal hopes

- Prices of the WTI rebound from 18-year lows on Tuesday.

- US-Russia agreed to start talks aimed to stabilize the market.

- API’s weekly report on US inventories coming up next.

After plummeting to levels last seen nearly two decades ago near the $19.00 mark per barrel, prices of the WTI are seeing some respite and have so far regained the $21.00 level on Tuesday.

WTI firmer on hopes of a US-Russia deal

Prices of the American benchmark for the sweet light crude oil have reversed Monday’s deep pullback to the vicinity of the $19.00 mark per barrel in response to traders’ hopes on a potential US-Russia deal in order to stabilize the oil market.

In fact, speculations on an agreement between both oil-producer countries have been running high since early on Tuesday, bolstering the sentiment in the commodity following Monday’s call between President Trump and Russia’s Vladimir Putin.

It is worth mentioning that prices of the barrel of the black gold have already shed nearly 69% so far this year, and over 70% if we consider early January 2020 highs just below the $66.00 mark.

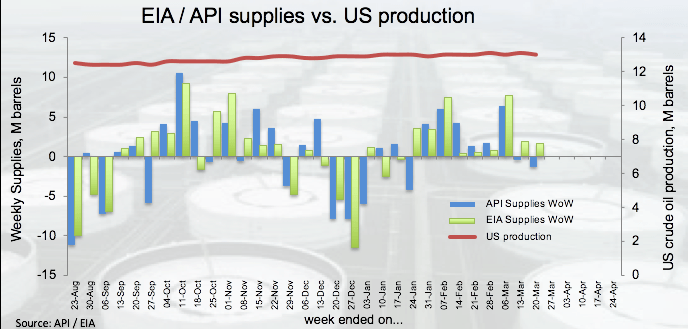

Later in the NA session, the American Petroleum Institute will publish its weekly report on US crude oil stockpiles ahead of the EIA’s report on Wednesday.

What to look for around WTI

Crude oil prices remain under unabated pressure despite the ongoing rebound from new 18-year lows near $19.00 per barrel recorded at the beginning of the week. The broader picture, however, remains unchanged and dominated by supply and demand concerns stemming from the Russia-Saudi Arabia price war and the impact on the industry of the coronavirus. Also adding to oversupply concerns, there is still the palpable possibility that Saudi Arabia could carry on with its plans to increase oil exports by more than 10M bpd in May. A potential relief to this low-lower-prices-scenario could come in the form of a US intervention, which is expected to morph into some sort of agreement between the US, Russia, Saudi Arabia and some other countries.

WTI significant levels

At the moment the barrel of WTI is gaining 4.50% at $21.13 and a breach of $19.29 (2020 low Mar.30) would expose $17.12 (monthly low November 2001) and finally $10.65 (monthly low December 1998). On the upside, the next resistance aligns at $25.20 (weekly high Mar.25) followed by $28.46 (high Mar.20) and then $30.07 (21-day SMA).