AUD/JPY Price Analysis: Bulls retain control above 74.50 following BOJ

- AUD/JPY seesaws around four-day high after BOJ meeting.

- BOJ increased lending facilities from 75 trillion yen to 110 trillion yen.

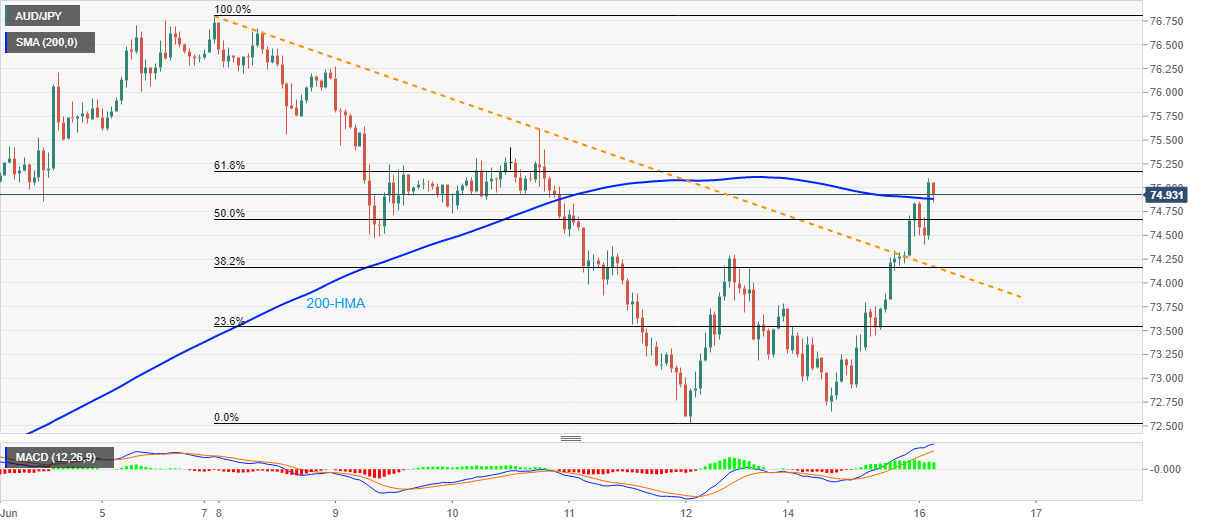

- A sustained break above weekly falling trend line, bullish MACD keeps the buyers hopeful.

AUD/JPY eases from intraday high, also the multi-day top, of 75.09 to 74.88 during the early Tuesday’s trading session. The pair’s recent moves could be traced from the Bank of Japan’s (BOJ) monetary policy decision which offered an increase in the size of the loan program while also citing the downside economic risks of the coronavirus (COVID-19).

Read: BOJ leaves its monetary policy settings unchanged in June

However, the pair’s successful break above a one-week-old descending trend line, followed by the ability to pierce 200-HMA, enables the bulls to cheer 0.83% gains by the press time. Additionally, upbeat signals from the MACD histogram also favor the bulls.

As a result, the buyers are likely targeting 61.8% Fibonacci retracement of June 07-12 fall, around 75.20, during the further upside. Though, 75.60 and 76.25 might question the pair’s extra rise ahead of pushing the optimists towards challenging the monthly top near 76.80.

Alternatively, a 200-HMA level of 74.85 and the resistance-turned-support around 74.17 could entertain short-term sellers in a case of fresh pullback moves.

If at all there prevails additional weakness on the part of the pair past-74.17, 73.80, 73.00 and monthly bottom close to 72.60/55 will gain the bears’ attention.

AUD/JPY hourly chart

Trend: Bullish