USD/INR Price News: Indian rupee sellers await upside break of 75.70

- USD/INR bounces off two-week low to defy three-day losing streak.

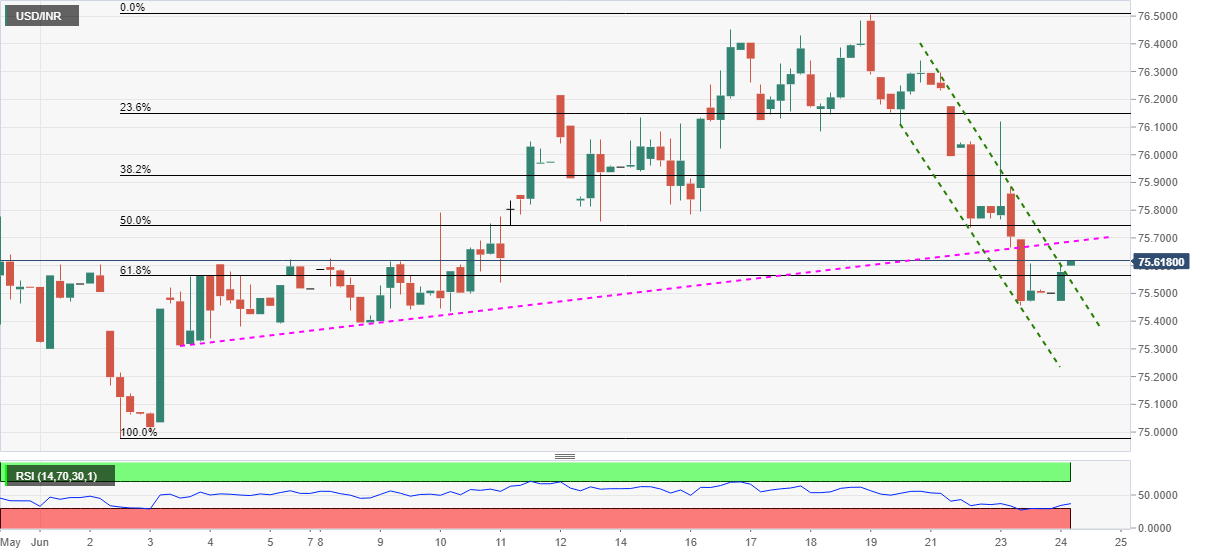

- Confirmation of a bullish chart pattern, oversold RSI favors further pullback of the pair.

- 75.30 could lure the short-term sellers ahead of the monthly low.

USD/INR rises to 75.60, up 0.10% on a day, ahead of the European session on Wednesday. The pair recently broke a three-day-old falling channel formation amid oversold RSI conditions. However, the quote is still below an ascending trend line stretched from June 03.

Considering the sustained break of an immediate descending channel, backed by oversold RSI, the USD/INR prices are likely to extend the latest recovery moves. In doing so, the tree-week-old support-turned-resistance around 75.70 becomes the immediate upside barrier.

Should buyers manage to dominate past-75.70, June 18 low near 76.08 and the monthly top close to 76.50 will become their favorites.

Alternatively, 61.8% Fibonacci retracement level of the current month’s upside and Tuesday’s low, respectively around 75.56 and 75.45 respectively, become nearby supports to watch during the fresh declines.

In a case where the bears keep the reins past-75.45, 75.30 and 75.00 will return to the charts.

USD/INR four-hour chart

Trend: Further recovery expected