Gold bears lining-up for potential profit-taking scramble

- Gold consolidates as market get set for a breakout, one way or the other.

- Month-end flows could be the trigger to set off a phase of distribution.

The price of gold has accumulated bids and offers in a precarious spot on the charts, drawing in anticipation of a phase of distribution.

On the day, the price has stuck to a tight range of between $1,765.94 and $1,775.69 and is down by 0.07% at the time of writing.

However, gold futures settled with a modest gain and leaves the prospects for a positive half of a year by quarter-end for prices.

COVID-19 is a major factor for gold's safe-haven flows and a second wave hitting global economies, is bound to keep prices elevated.

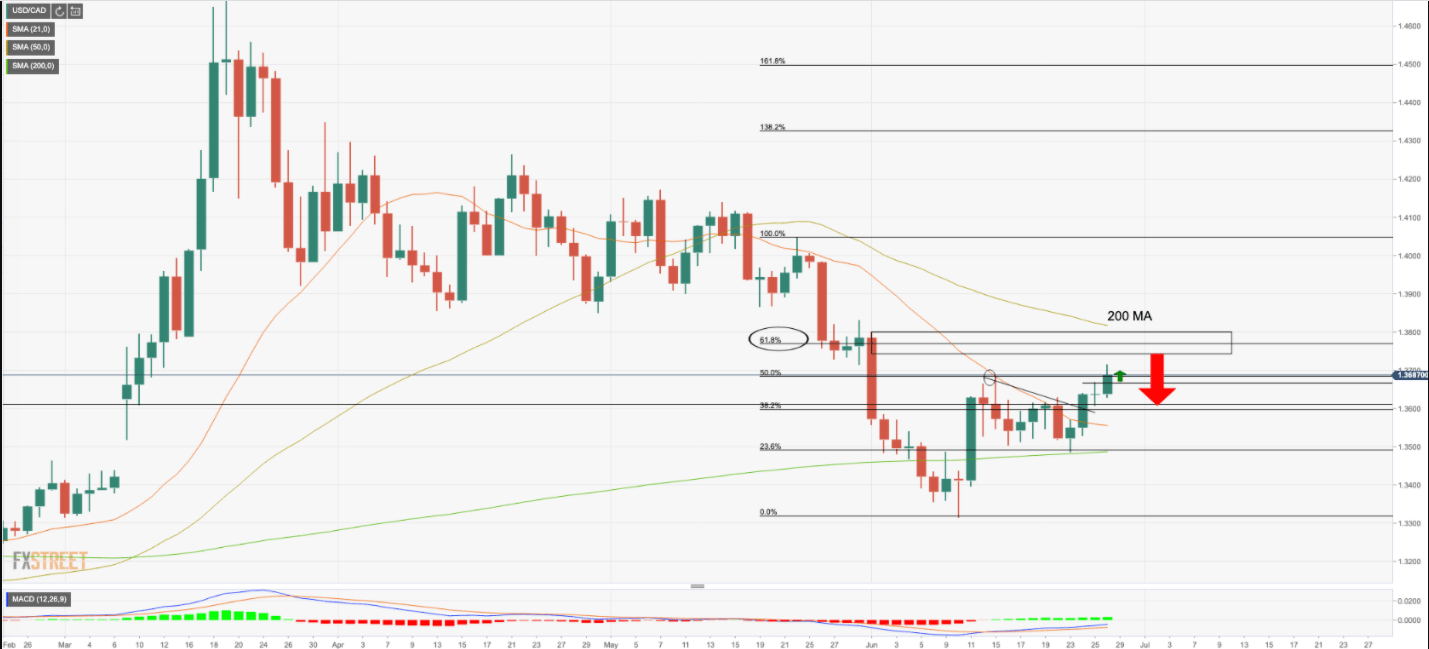

However, profit-taking could well be a consequence of month-end which could potentially lead to a technical breakdown in the chart. See below.

Declining real rates should imminently support gold prices into the $1800s

However, the fundamentals are a likely factor to keep bears second guesing.

"Indeed, with rates vol constrained, rising long-term inflation expectations have been a powerful driver lifting gold prices higher,' analysts at TD Securities explained.

Price action continues to lend strength to our view that gold's role is shifting from a safe-haven asset, to an inflation-hedge product.

Looking forward, we also see substantial room for this driver to run, as the entire maturity spectrum of inflation breakevens are still priced below policy objectives.

In this context, declining real rates should imminently support gold prices into the $1800s.

The analysts also explained that "the world-war era fiscal and central bank stimulus, the change in the central bank template that will incorporate 'symmetric inflation targets' and unwinding globalization, also suggest that inflation-hedge assets may grow in popularity.

Eventual tailwinds in commodity demand should also be particularly supportive of silver prices, which have retained their historically high sensitivity to their industrial component.'

Gold levels

- Gold Price Analysis: XAU/USD bears lining up for potential phase of distribution

-

Gold Price Analysis: The XAU/USD price is stalling at the current lofty levels for now