Gold Price Analysis: XAU/USD forming an overextened W-formation

- Gold prices have formed an overextended W-formation and resistance expected to hold initial tests.

- Bulls will seek a discount from at least a 38.2% Fibonacci retracement of the latest bullish impulse.

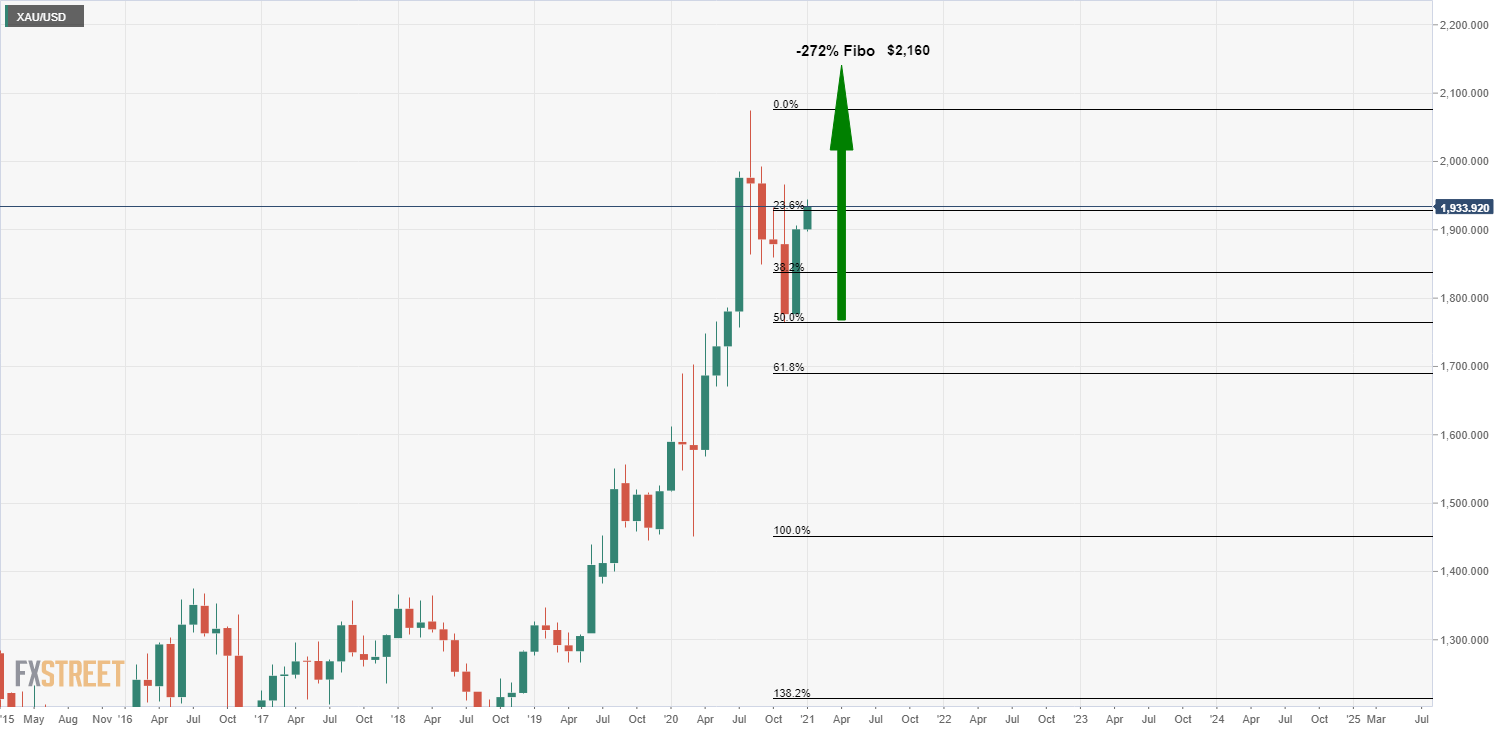

Further to the start of the week's analysis on gold, The Chart of the Week: Gold's technical allure with ebbs and flow between here and $2,160, the price action is playing out accordingly.

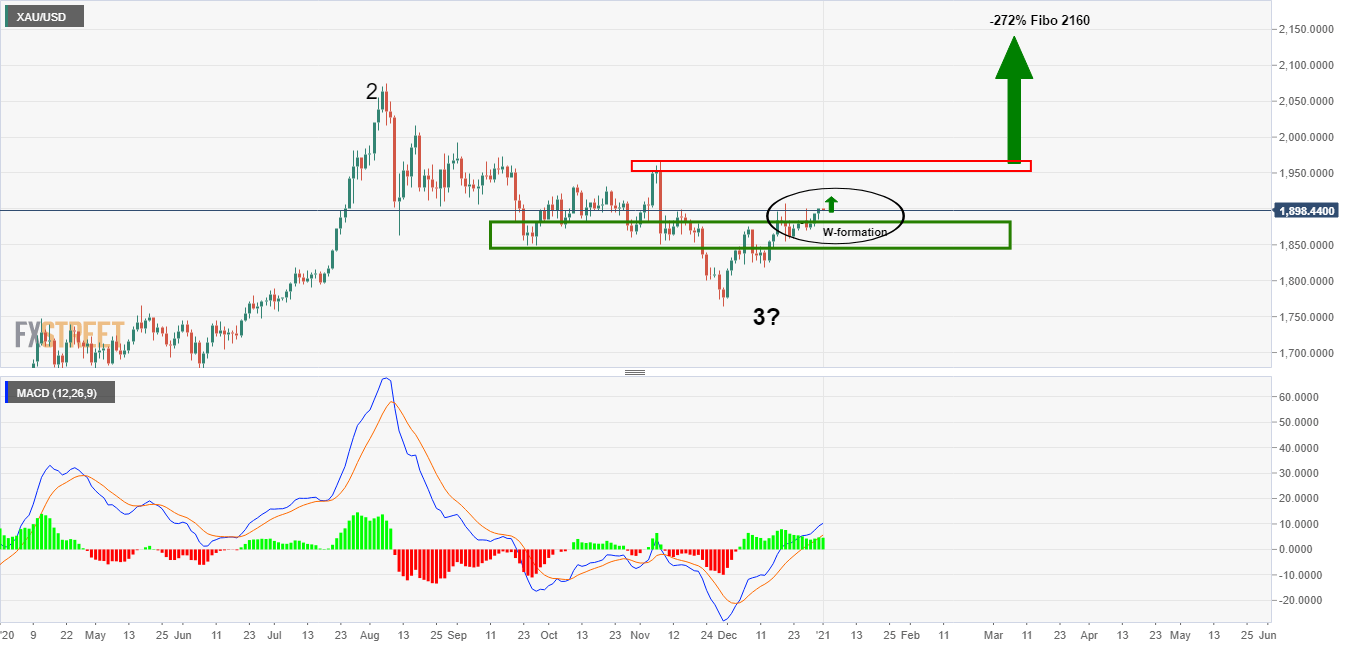

An extended W-formation is in play with the price on Monday bursting higher by over 2% from a low of $1,898.39 to a high of $1,944.51.

In the Asia open, it was forecasted that the price could rally and form an overextended W-formation:

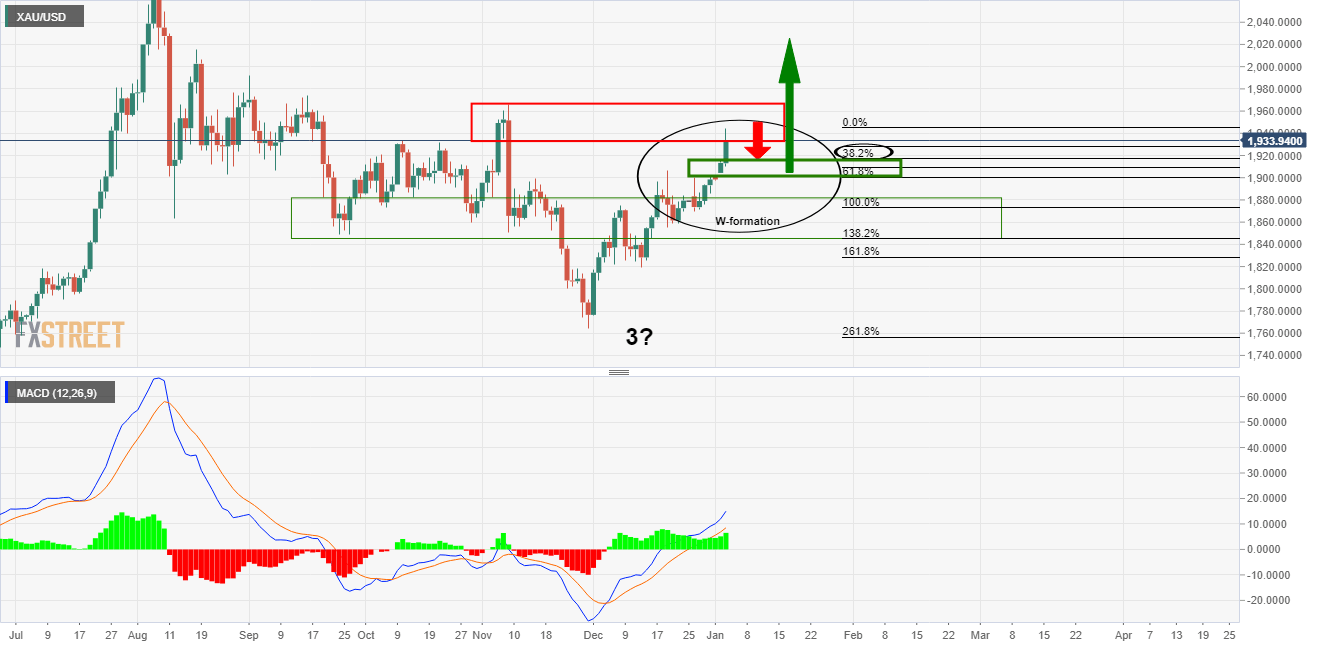

Today's price action

The expectations from here would be for the price to retrace to at least a 38.2% Fibonacci retracement before resuming the upside, based on a monthly and weekly analysis:

Daily chart prospective price action

Resistance would be expected to hold up the bulls on initial tests.

This would offer an opportunity for a discount from at least the 38.2% Fibonacci of the latest impulse prior to a resumption of the uptrend.

Monthly chart

As per the start of the week's analysis, the monthly chart corrected to a 50% mean reversion.

Therefore, the expectations are that gold will continue with an upside extension of the bullish trend.