AUD/USD: Bulls prepping up for a sustained move above 0.7800

- AUD/USD cheers covid vaccine landing in Australia, Yuan strength.

- The US dollar remains broadly weaker amid risk-on mood.

- Thin trading conditions could add to the bullish momentum.

After a brief consolidative stint in early trades, AUD/USD caught a fresh bid-wave, now closing in on the 0.7800 barrier amid broader market optimism.

The risk sentiment remains lifted amid positive developments on the coronavirus vaccines front worldwide. The aussie bulls cheer the arrival of the first shipments of Pfizer Covid-19 vaccines in Australia, as the rollout is likely to kick-off by the end of this month,

Markets shrugged off the news of a fresh lockdown announced in New Zealand amid traces of new covid strain from the UK. Broad-based US dollar strength and the rally in S&P 500 futures continued to bode well for the aussie pair.

The major could likely benefit from holiday-thinned trading conditions the strength in the Chinese yuan while technicals continue to point north.

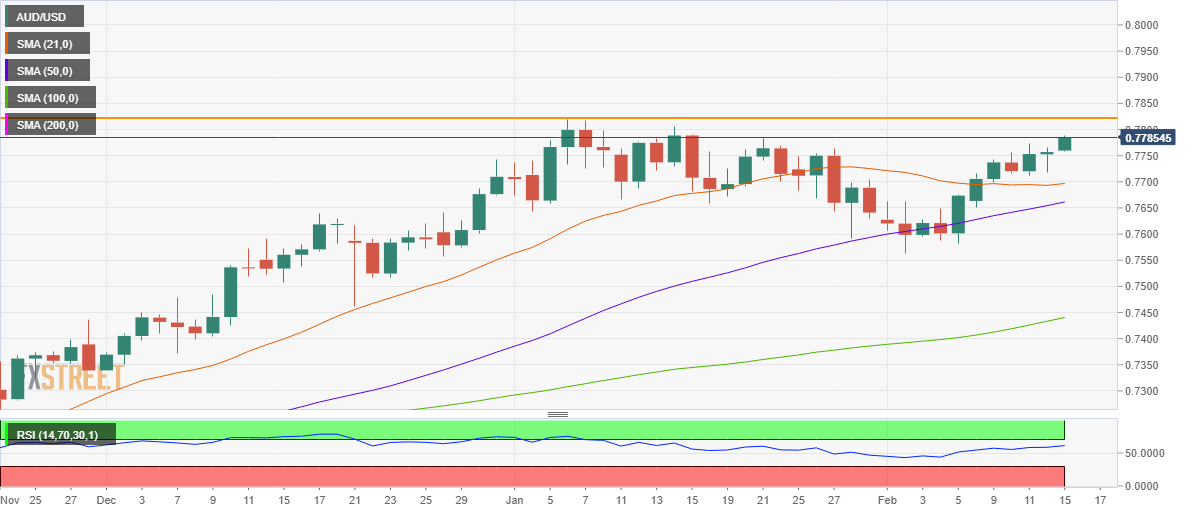

AUD/USD: Daily chart

The aussie is looking to regain the 0.7800 level, above which the horizontal trendline resistance at 0.7820 could be challenged. A big move could be in the offing on a sustained breakthrough the latter, with the 0.7850 barrier next in sight.

The 14-day relative strength index (RSI) points north while above the midline, suggesting that there is more room to the upside. The spot also trades above all the major simple moving averages (SMA) on the said timeframe.

Alternatively, Friday’s low of 0.7718 could be tested, below which the 21-SMA at 0.7697 would be on the sellers’ radar.