AUD/USD Price Analysis: Attacks 50-HMA as selling pressure intensifies

- AUD/USD challenges critical support amid surging Treasury yields.

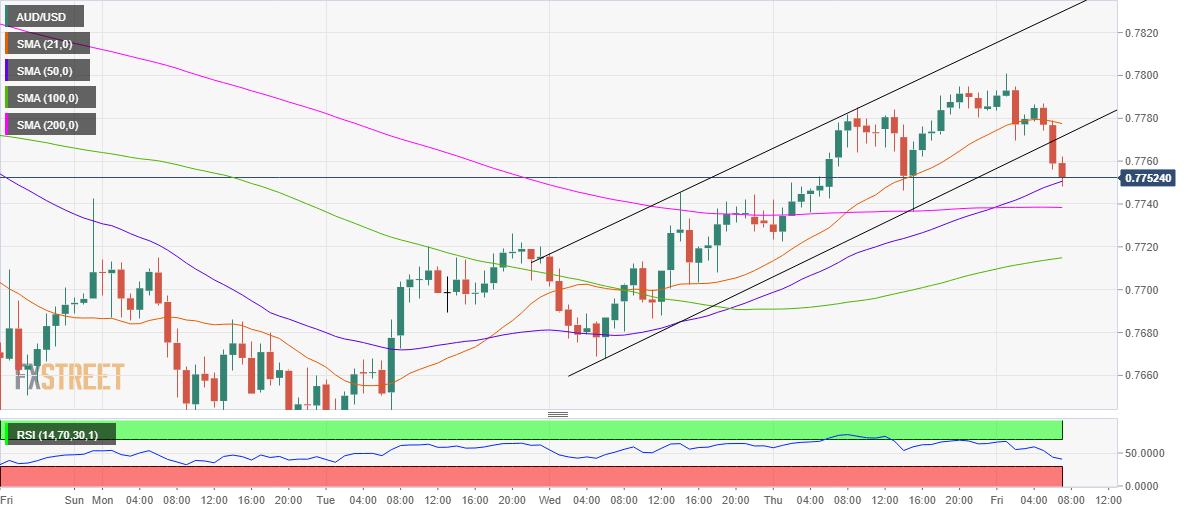

- The aussie spots a falling channel breakdown on the hourly sticks.

- RSI stays bearish, allowing room for more declines.

Having faced rejection at 0.7800, AUD/USD extends the reversal towards the 0.7700, as the renewed strength in the US Treasury yields boosts the greenback across its main peers.

The sentiment around the spot remains undermined by the uptick in the Treasury yields, as they dull the aussie’s attractiveness as an alternative higher-yielding asset.

The reflation trade is back in vogue amid the US stimulus passage and President Joe Biden’s upbeat remarks on the vaccine campaign.

The yield price action will continue to dictate the tone around the aussie while the US PPI data could likely offer some incentives.

AUD/USD: Technical Outlook

As observed on the hourly chart, the aussie has validated a falling channel breakdown, calling for a test of 0.7650 levels.

Ahead of that level, the bears need to sustained move below the 50-hourly moving average (HMA) at 0.7750.

The 200-HMA at 0.7735 could also offer strong support. The relative strength index (RSI) points south below the midline, suggesting that there is more scope to the downside.

Alternatively, any recovery attempts could meet the initial demand at the pattern support now resistance at 0.7771.

The next resistance awaits at the daily high of 0.7800.

AUD/USD: Hourly chart

AUD/USD: Additional levels