Gold Price Analysis: XAU/USD reaches deeper into monthly resistance

- Gold is running into a wall of resistance on the longer time frames.

- Bears will be looking for a correction to restest the prior resistance.

At the time of writing, the gold price is trading a touch higher in Asia by some 0.13% in XAU/USD.

XAU/USD rose by 1.26% to $1,868.50 on Monday and has added a buck to reach a new cycle high of $1,869.71 on a cautious start to the week for global financial markets.

Overnight, global equities were under pressure with bond yields edging higher making for a Goldilocks scenario for gold as markets fret over the US inflation story following last week's CPI beat.

Meanwhile, the Federal Reserve's vice chairman Richard Clarida has said the Fed will respond to higher inflation should that be required, but he and others, including Fed’s chair, Jerome Powell, have constantly insisted that now is not the time to start taper talk while employment remains deep in a hole.

We will see the minutes on Wednesday from the Federal Reserve's policy meeting last month.

Investors will be on the lookout for more meat on the bone in the policymakers' outlook of an economic rebound and clues regarding their thinking about inflation spikes and the ongoing economic recovery.

Money managers increased net length

Meanwhile, analysts at TD Securities explained that money managers ultimately increased their net length as the disappointing non-farm print catalyzed a round of algorithmic short-covering, helping prices to break out north of the $1800/oz range.

''At the same time, we've noted that the composition of gold flows is changing, highlighting that discretionary capital could once again be flowing into gold, but rising ETF flows alongside money manager positioning have since lent strength to this view — particularly as the "transitory" debate surrounding inflation gathers share of mind.

Pick your poison, but the most plausible scenarios should all see gold prices ultimately firm.''

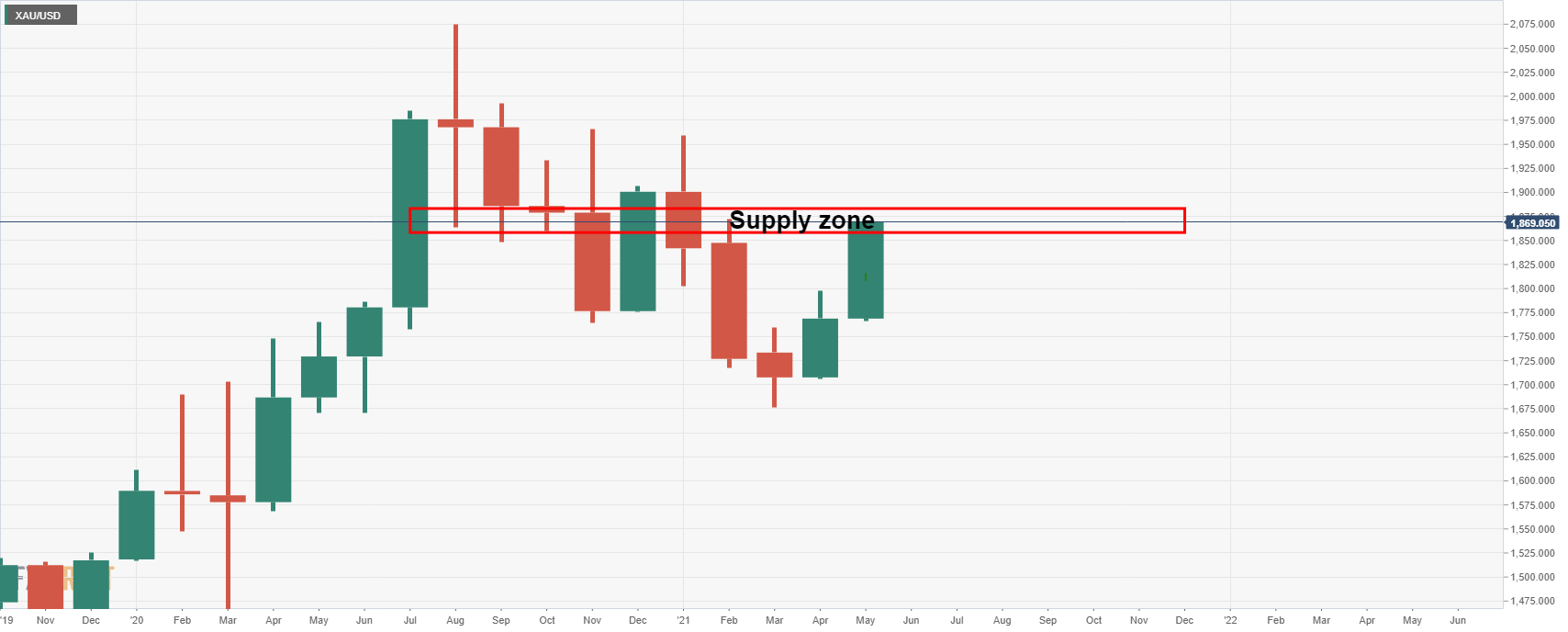

Gold technical analysis

As per the prior analysis, Chart of the Week: Gold on the approach to $1,855, the price of gold has added to Friday's bullish close.

Prior analysis, daily chart

'From a daily perspective, the bulls are taking on the prior highs and closed Friday's session strongly bid.

A run into the psychological $1,850 is on the cards with a -272% Fibo retracement of the prior correction coming in at $1,855.'

Live market, daily chart

Meanwhile, the -272% Fibo retracements of the prior correction coming in at $1,855 were cleared with ease.

In fact, we have seen a perfect touch of the -61.8% Fibo at the day’s highs.

A correction is the most probable scenario at this juncture revealing a 38.2% Fibonacci retracement level for the forthcoming sessions at $1,845.

In looking to the longer-term time frames, this also jives considering the market structure on the monthly chart as follows:

While an upside continuation is still a possibility, the monthly supply zone could be a tough nut for the bulls to crack straight away.

Additional reading:

Gold Weekly Forecast: XAU/USD bulls eye $1,850 after regaining control