Back

28 Jun 2021

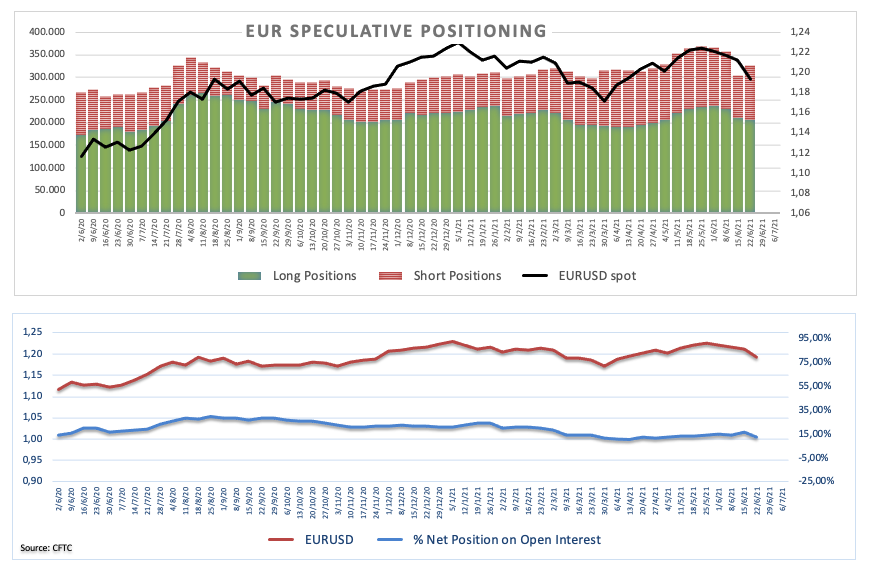

CFTC Positioning Report: EUR net longs at 2-month lows

These are the main highlights of the CFTC Positioning Report for the week ended on June 22nd:

- Speculators increased markedly their gross shorts in the European currency during last week and following the shift to a less dovish stance from the FOMC, taking the net longs to the lowest level since early May. The move in the speculative community echoed the sharp drop in EUR/USD to the mid-1.1800s, where it met some decent support so far.

- Net shorts in the dollar eased to YTD lows after the Fed caught investors off guard at its meeting. The DXY, however, run out of steam in the vicinity of the 92.50 level, sparking some consolidation soon afterwards.

- Net longs in the sterling receded sharply to levels last seen in early February. Cable lost around 3 cents in tandem with the strong appreciation of the greenback.

- The rally in crude oil prices stays well reflected on the speculative community, as net longs increased to 3-month highs. Prospects of higher demand, the OPEC+ decision to increase output already priced in plus the higher inflation narrative continued to fuel the upside in the commodity.