USD/JPY bears seeking a test of 109.80s

- USD/JPY bears are in control as the yen picks up the safe-haven bid.

- US Treasury dynamics should remain the main driver for the yen.

USD/JPY is down 0.2%, taking out the 110 level falling from a high of 110.11 and testing a low of 109.85, so far.

On Friday, USD/JPY initially rose from 110.00 to 110.34 before falling to 110.04 as the bulls ran out of steam due to a risk-off turn on Wall Street.

The dollar index DXY, which measures the greenback against a basket of six currencies, was ending 0.16% higher at 92.712. The index is up 0.6% for the week but the yen picked up a safe haven bid.

US Retail Sales unexpectedly rose in June as demand for goods remained strong.

Solid data and a shift in interest rate expectations after the Federal Reserve flagged in June sooner-than-expected hikes in 2023 have contributed to the strength in the greenback in recent weeks.

However, the bears are out in force, targeting the prior lows in the 109.70s, potentially due to mixed messages from Fed members as well as the weekend covid headlines.

For instance, while Fed Chair Jerome Powell was reiterating on Thursday that rising inflation was likely to be transitory, other members, such as James Bullard, are calling for immediate tapering.

As investors weigh the contradictions from Fed officials, the spread of the delta virus is concerning which weighed on US benchmarks on Friday.

COVID spread weighing on market's risk appetite

The Dow Jones Industrial Average slid 0.9% to 34,687.85 and the Nasdaq Composite dropped 0.8% to 14,427.24. The S&P fell 0.75% to 4327.16, closing near the lows but losing just 1% this week.

Additionally, US bonds rallied and the yield curve bull flattened for the third consecutive trading day and the re-flattening of the US yield curve has once again provided some support to the yen.

The yen, which has been the only currency with the Kiwi dollar able to outperform the dollar last week.

In fact, the 60-day correlation between USD/JPY and US 10-year yields is at the highest since June 2020.

Therefore, US Treasury dynamics should remain the main driver for the yen.

Bulls will want to see an improvement in risk sentiment that could prompt some JPY weakness, but for the time being, the focus is on the downside.

USD/JPY technical analysis

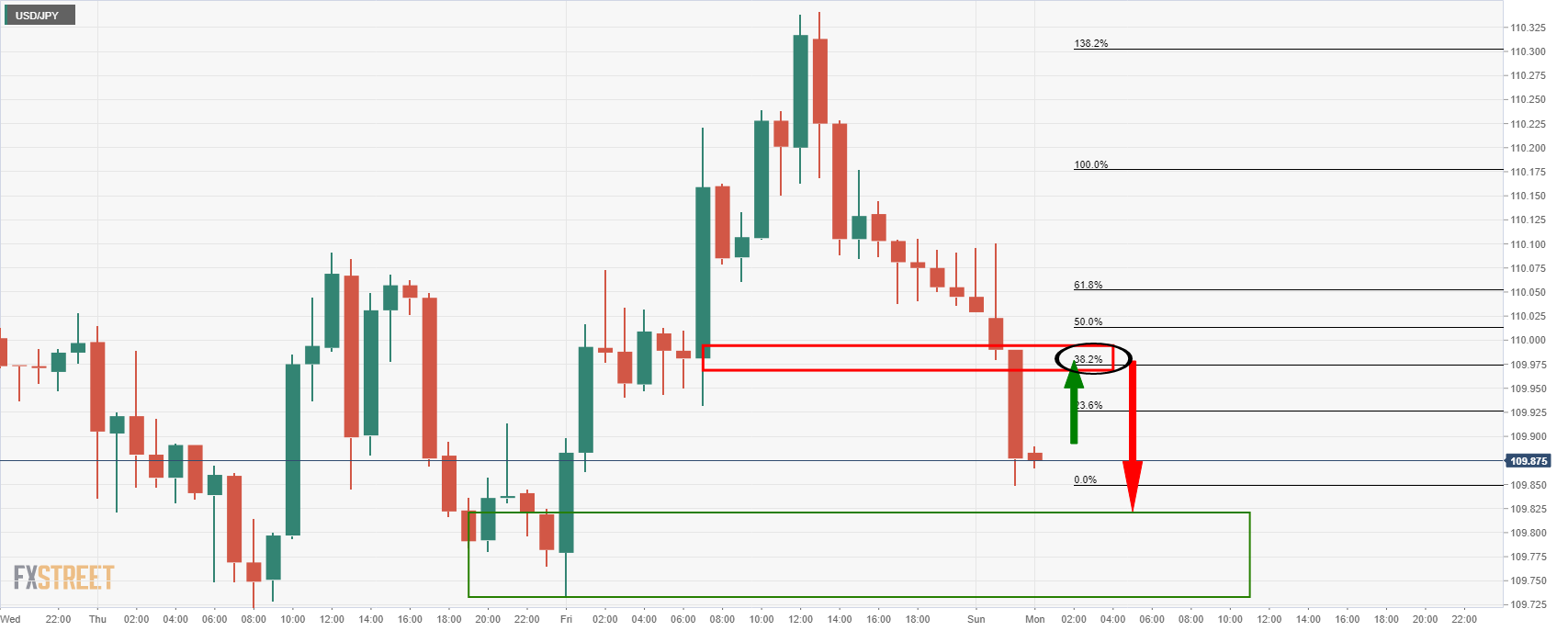

A correction, in the meanwhile, could be on the cards following a series of uninterrupted hourly bearish candles.

The resistance and confluence with the 23.6% and 38.2% Fibonaccis are compelling for a restest prior to the next downside impulse to test the bull's commitments at the 109.80 level.