NZD/USD probing 0.7200, set to remain rangebound ahead of key risk events

- NZD/USD is probing the 0.7200 level and NZD is an outperformer on Monday, but the pair is within recent ranges.

- Catalysts for a break out of recent ranges include Wednesday’s NZ jobs data or FOMC meeting, or US NFP.

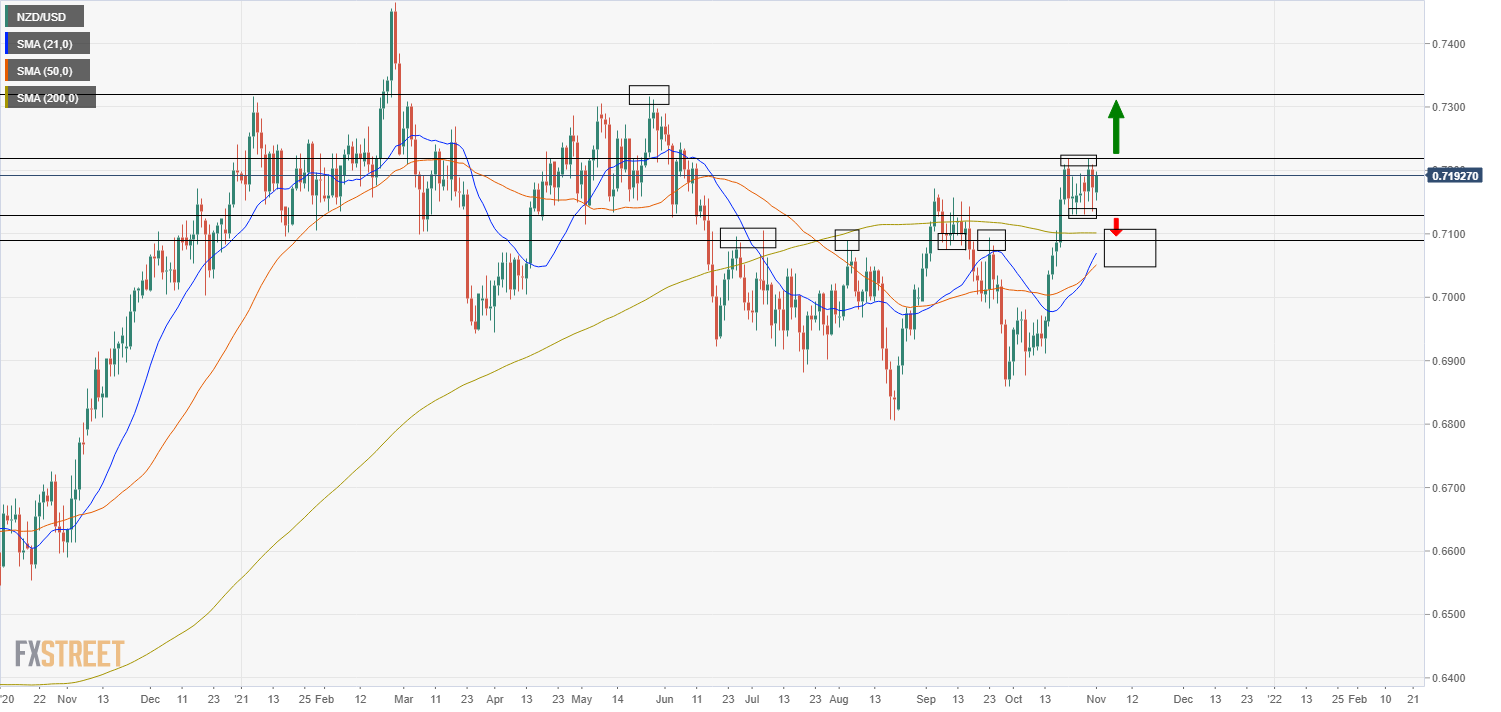

Despite a lack of any specific fundamental catalysts relating to New Zealand, the kiwi is one of the better performing G10 currencies on Monday, with NZD/USD nursing gains on the day of about 0.4%. Currently probing the 0.7200 level, the pair remains well within the well-established 0.7130-0.7220 range of the last week and a half. A stronger than expected number for the headline US ISM Manufacturing index for October (which came in at 60.8 versus forecasts for 60.5), as well as further increases in the employment subindex to 52 and prices paid index to an elevated 85.7, has thus far failed to result in broader USD strength, which is for now allowing NZD/USD to remain supported. The report contained further evidence that US (and hence global) manufacturing continues to suffer badly from supply chain disruptions, with auto production affected particularly badly, which should strengthen the Fed’s growing conviction that the supply side-driven inflation may take longer to fade.

Risk Events

Indeed, this week’s Fed meeting is a key event and will be a key driver of NZD/USD on Wednesday, as will the remainder of this week’s US data, such as the ISM Services PMI survey release (Wednesday) and October Labour Market Report (Friday). But FX market participants should also take note of key jobs data being released in New Zealand this week; the Q3 labour market report is set for release early on during Wednesday’s Asia Pacific session and the unemployment is seen dropping under 4.0% and potentially to its lowest since 2008. Westpac note that “employment indicators have all been notably strong over recent months, with job advertisements well above pre-Covid levels, unemployment benefit numbers falling, and filled jobs accelerating”, suggesting that the data should be strong and support the RBNZ’s stance that a gradual withdrawal of monetary policy stimulus is warranted.

If the range breaks

If NZD/USD breaks to the north of its recently established range, then technicians would likely target a test of the 26 May high at just above 0.7300 as the next stop for the pair. Strong NZ jobs data with hawkish implications for RBNZ policymaking could be a catalyst for a push in this direction. Conversely, if NZD/USD breaks its range to the south, the most immediate support to look at is around the 0.7100 level in the form of a bunch of recent lows and highs, as well as the 200-day moving average.