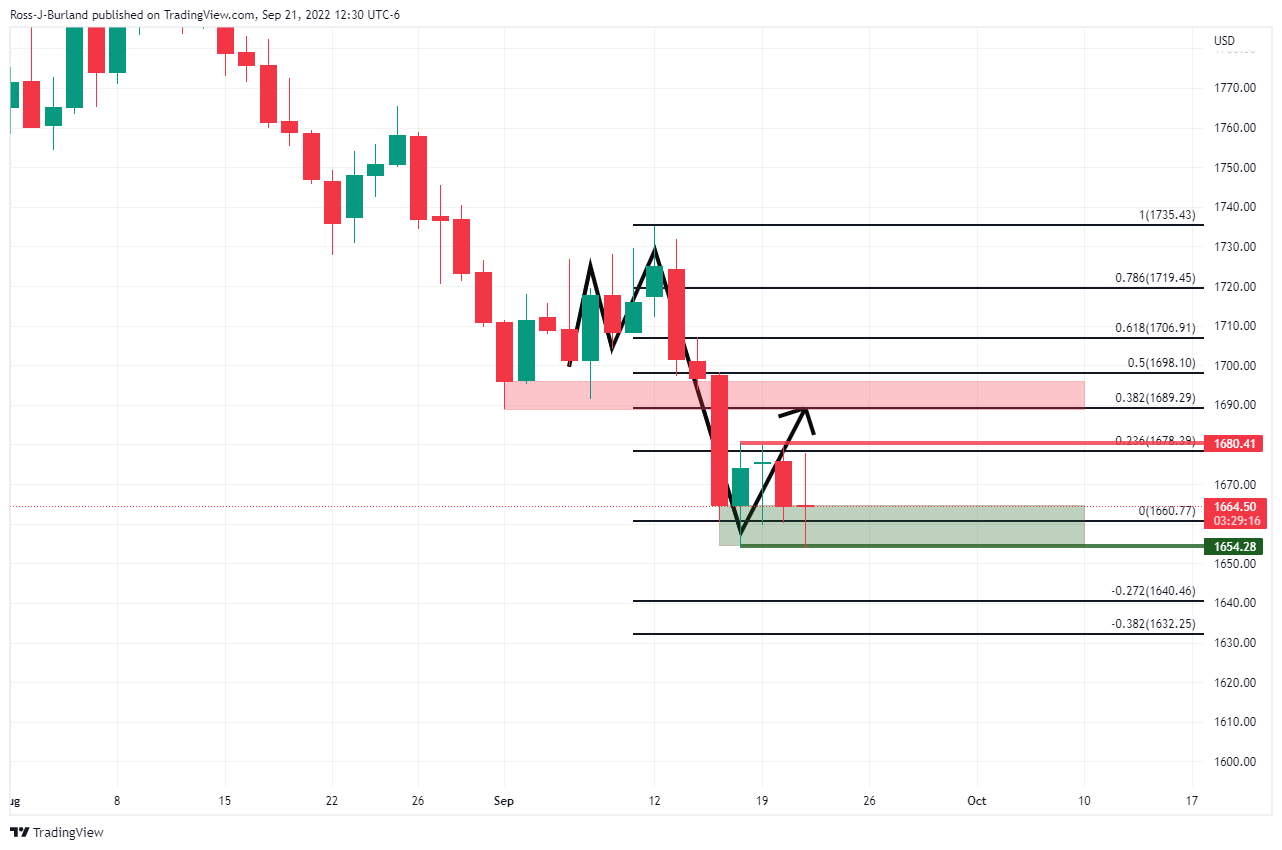

Gold Price Forecast: XAU/USD under pressure as Fed hikes by 75bps

- Gold is moving between highs and lows of the day post-Fed.

- Fed hikes rates by 75bps as expected, and remains committed to hiking rates further.

The gold price has extended its bear cycle trend to a fresh low following the Federal Open Market Committee's conclusion to its two-day meeting that resulted in the Federal Reserve deciding unanimously between its board members to hike interest rates by 75bps. The decision and further details surrounding the Fed's dot plot and economic forecasts have pressured the US yields and dollar higher which has weighed on gold. XAU/USD dropped from a pre-rate hike announcement of $1,669 to a low of $1,653.87 so far.

The expectations for higher rates while at the same time, investors fled for safety after a decision by Russian President Vladimir Putin to mobilize more troops for the conflict in Ukraine had already pushed the dollar to a two-decade high. The DXY index that measures the US dollar against a basket of currencies was breaching into the 111 area before the Fed. It has now gone on to print a post-Fed announcement high of 111.578 so far.

Fed key takeaways

- US Federal Reserve interest rate decision +75 bps vs +75 bps expected.

- Target Range stands at 3.00% - 3.25%.

- Interest Rate on Reserves Balances raised by 75Bps to 3.15% from 2.40%.

- The policy vote was unanimous.

- Fed anticipates ongoing hikes will be appropriate, prepared to adjust policy as appropriate.

- Board members are highly attentive to inflation risks and strongly committed to returning inflation to 2%.

- Recent indicators point to modest growth in spending and production.

- Ukraine war creates additional upward pressure on inflation, weighing on global economic activity.

- Inflation remains elevated, reflecting pandemic-related imbalances, and higher food & energy.

- Job gains have been robust, the unemployment rate has remained low.

- The median forecast shows rates 4.4% at end-2022.

- Futures after FOMC decision imply traders see 89% chance fed raising rates at another 75bps at the November meeting.

The focus will now turn to the Fed's chairman, Jerome Powell who will speak to the press:

Watch live: Fed Powell presser

Elsewhere, geopolitical tensions have been offering some support to gold.

The Russian president Vladamir Puti said he will mobilize an additional 300,000 troops to shore up the country's flagging invasion of Ukraine, where it is steadily surrendering territory to counter attacks from Ukrainian forces while making nuclear threats as well.

Gold technical analysis

More to come...